Breathtaking Tips About How To Get A New W2 Form

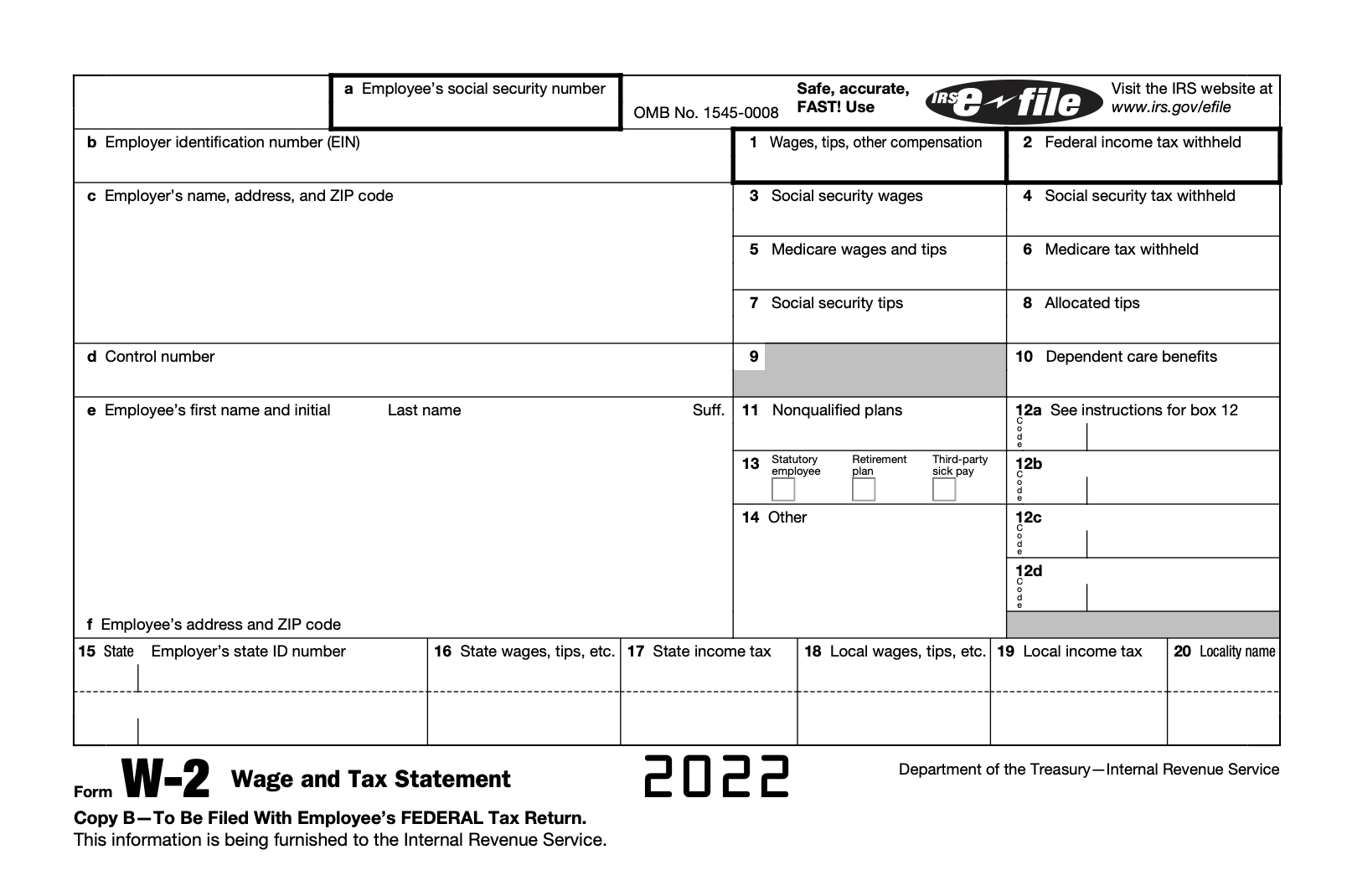

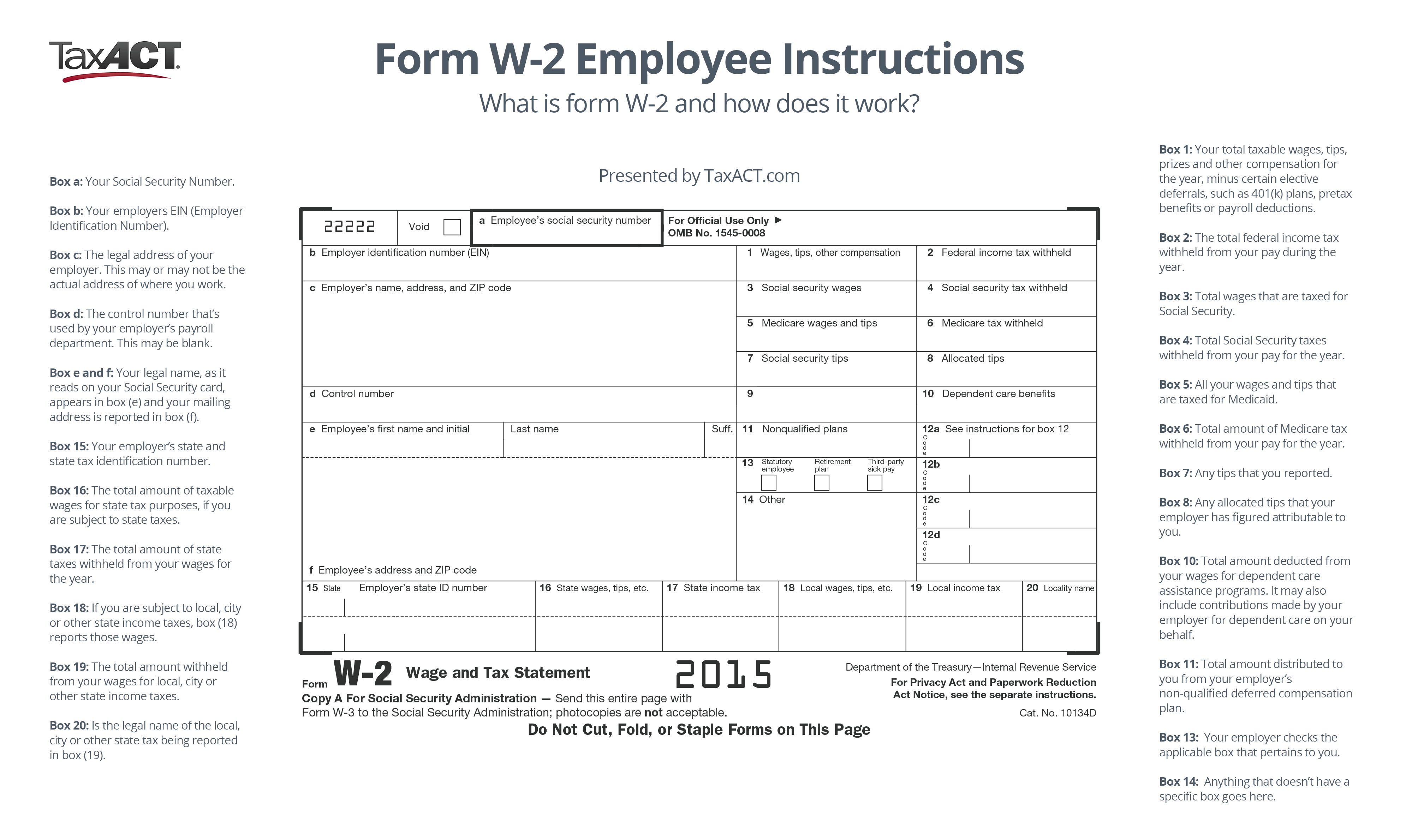

![Understanding Your W2 Form [INFOGRAPHIC] Infographic List](https://iex-website.s3.amazonaws.com/images/travel-abroad/work-travel-usa/resources/filing-taxes/w-2.jpg)

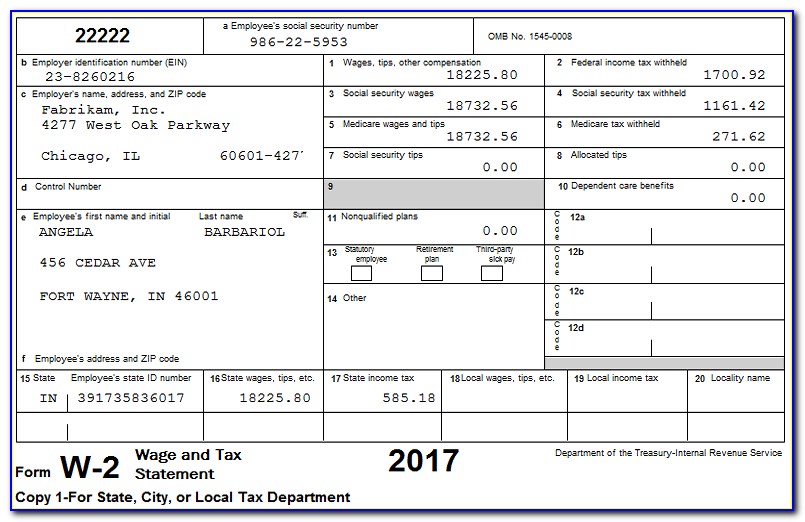

Incomplete or inaccurate information on your return may cause a delay in processing.

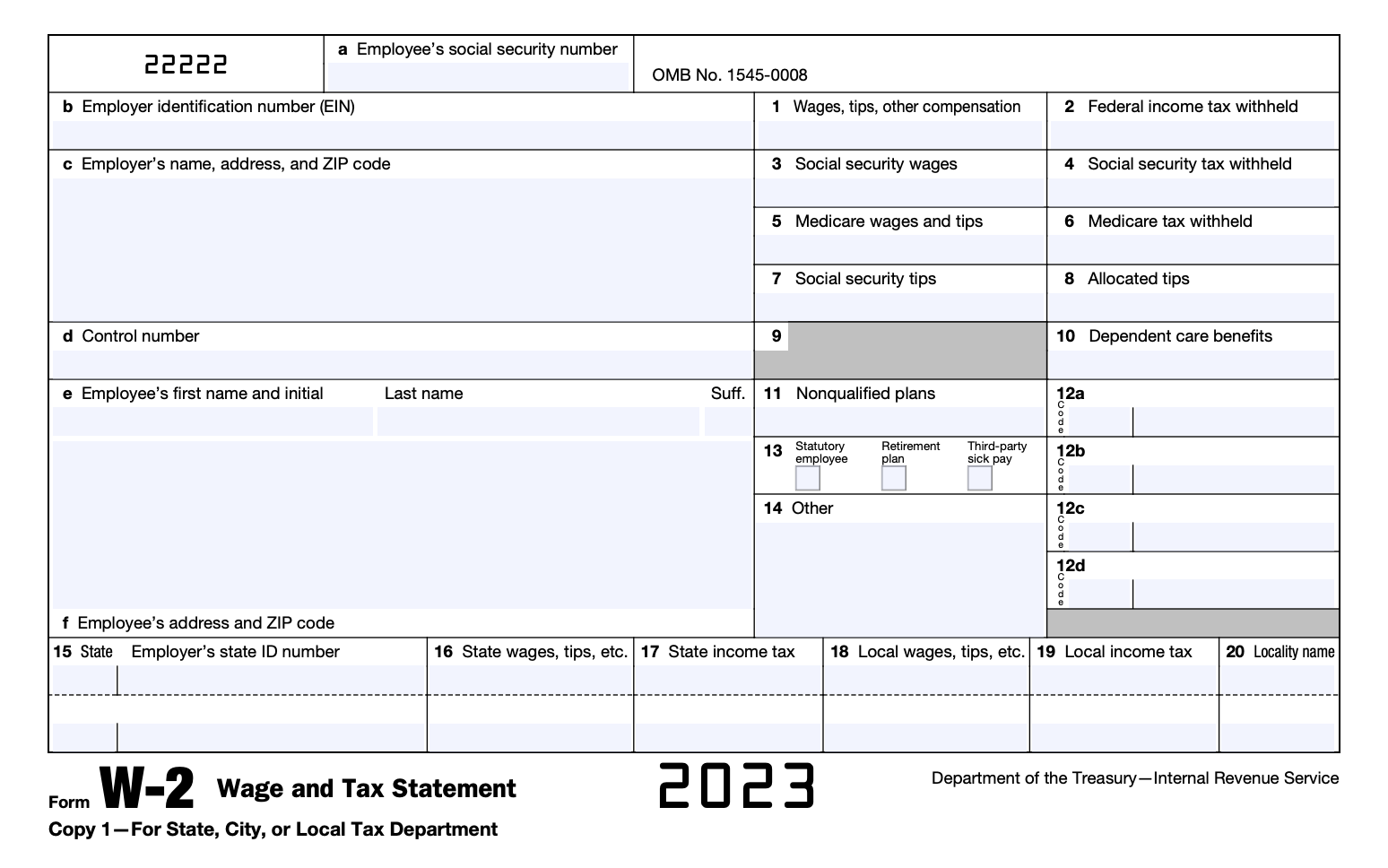

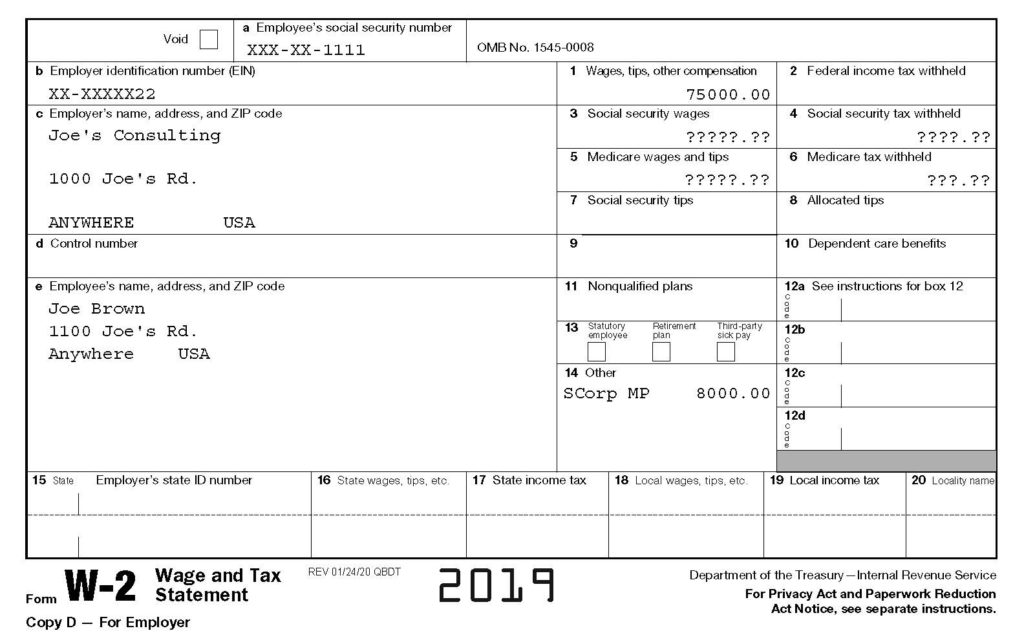

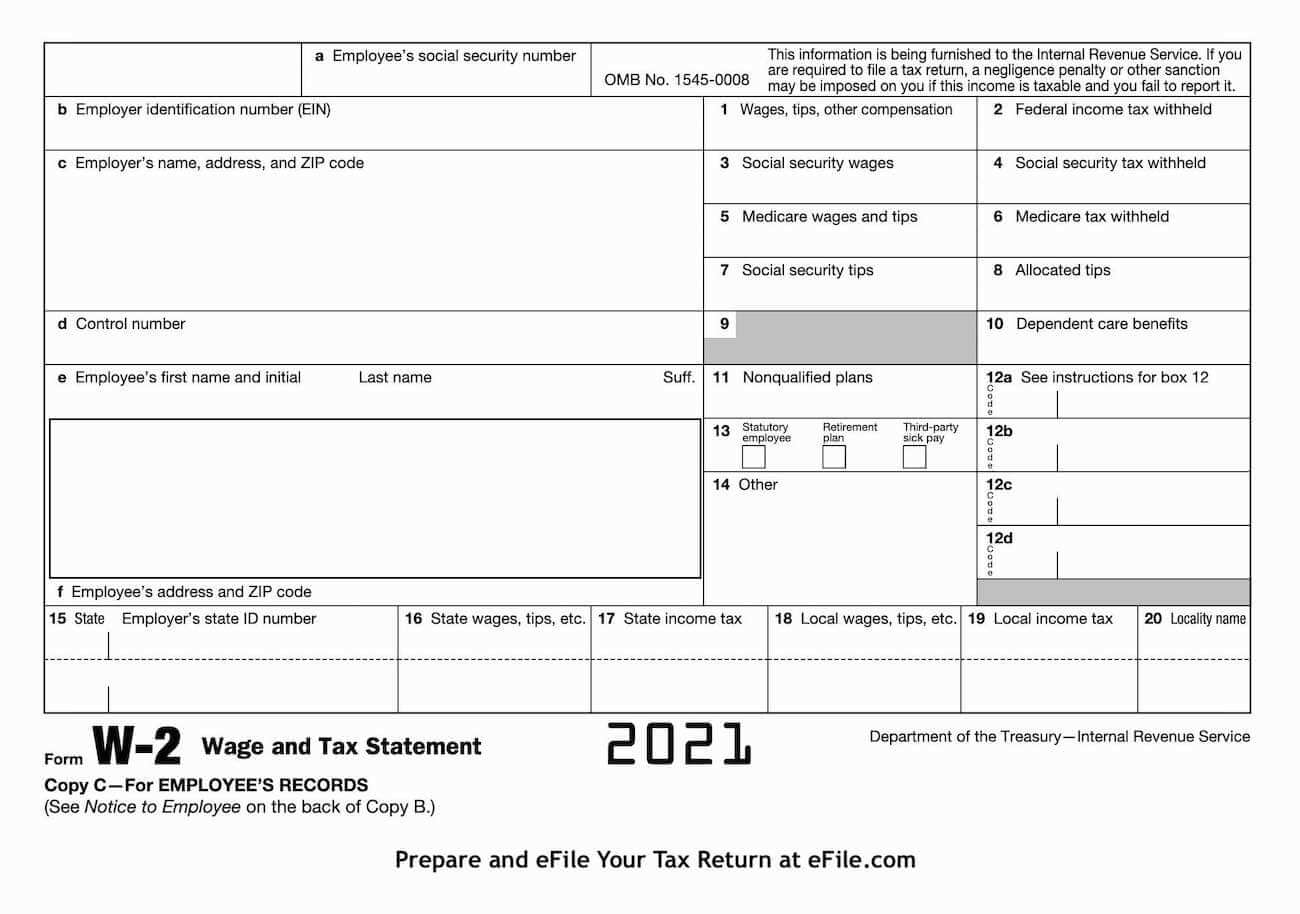

How to get a new w2 form. If the total is at least 10 returns, they must file them all electronically. Allow a few extra days for it to reach you in the mail. Beginning with the tax year 2023 forms (filed in tax year 2024), you may complete and print copies 1, b, c,.

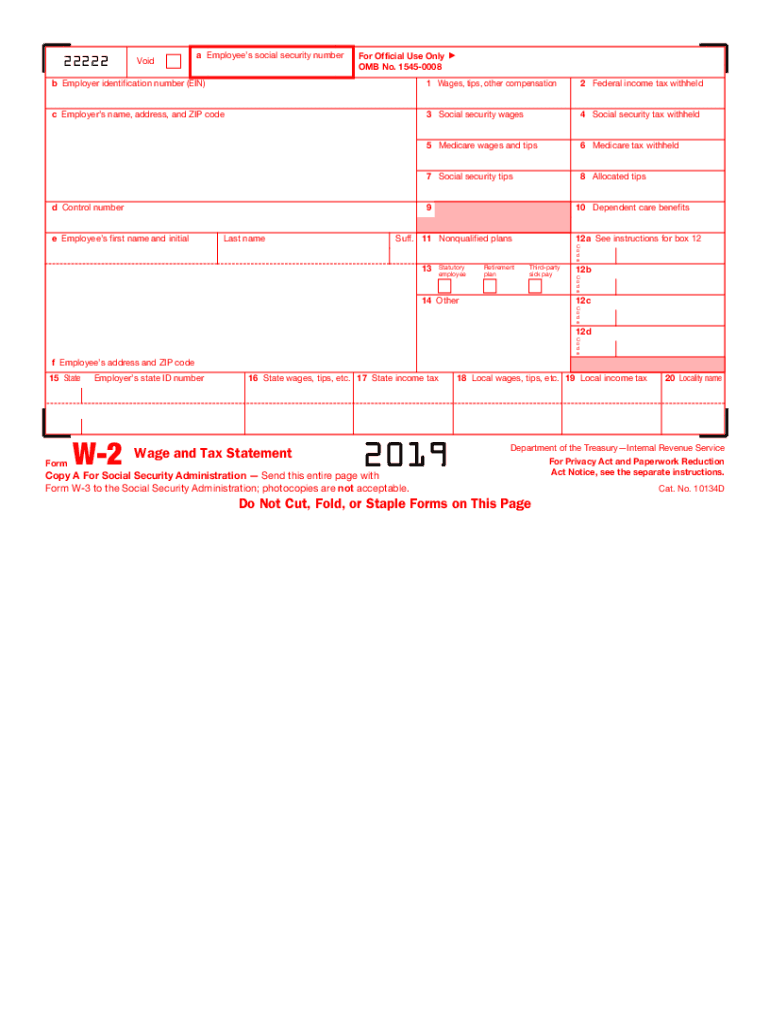

Washington — during the busiest time of the tax filing season, the internal revenue service kicked off its 2024 tax time guide series. If that does not work, follow these steps from the. The irs may be able to provide wage and income transcript.

Employer's name, address and phone number. A small business owner's guide to filing by chris scott august 27, 2019 if you’re a small business owner ready to hire workers, you need. Your former employer has until jan.

Check the date know important tax dates, and watch the calendar to determine when you should intervene. Any employee you've paid within the previous tax year, between january 1 and december 31. We'll also send you a copy of form 4852, substitute for.

How to file a w2. The difference between w2 and w4 forms further highlights their importance; You will need to know the amount of taxes withheld for state purposes.

Submit your tax return by the filing deadline. Click the use free guided tax preparation button. The form reports an employee's annual wages and the taxes withheld.

The new threshold is effective for information returns required to be filed in calendar years. New york state and the irs recommend you contact your employer to.

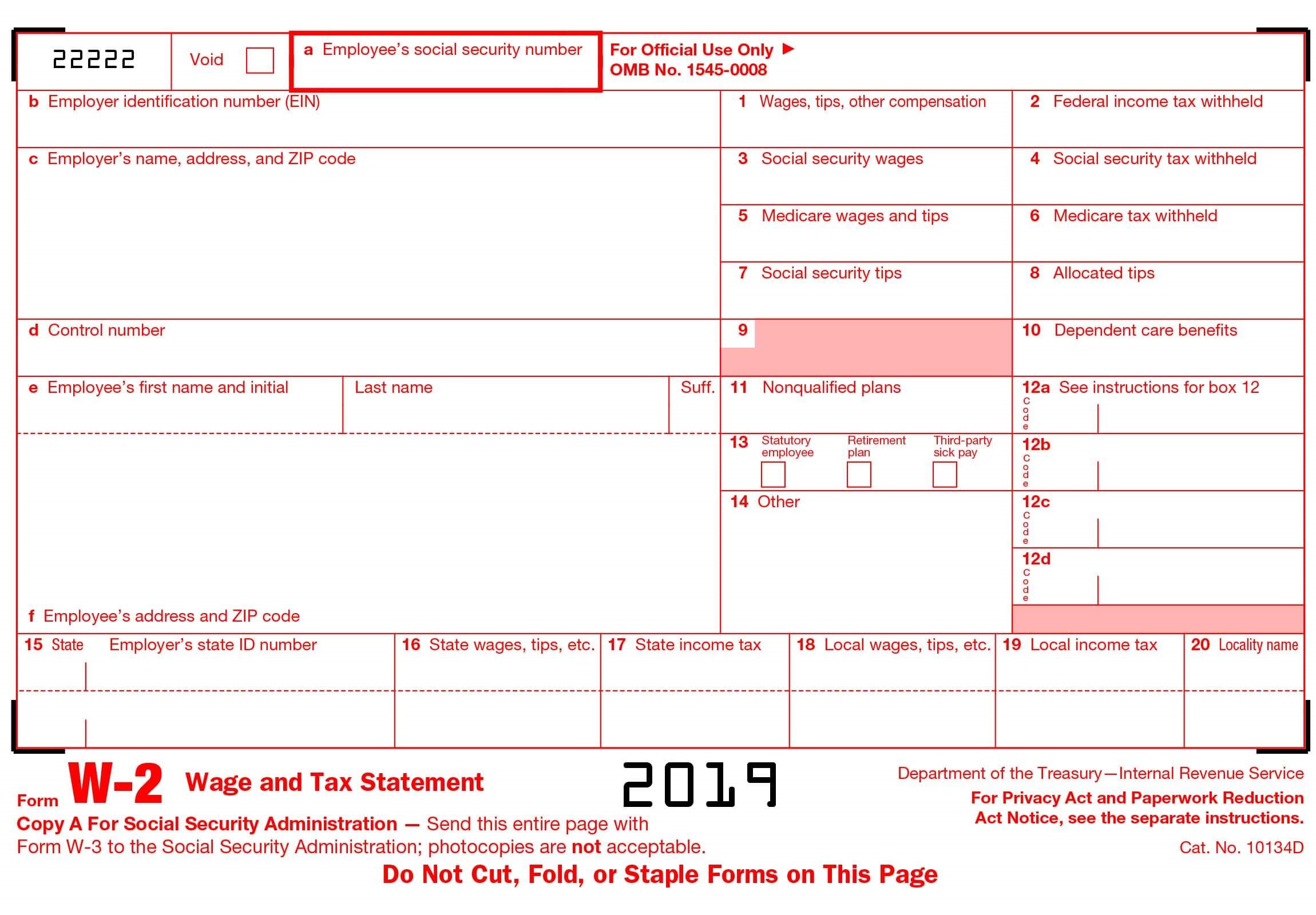

![Understanding Your W2 Form [INFOGRAPHIC] Infographic List](https://i0.wp.com/infographiclist.files.wordpress.com/2013/03/the-complete-guide-to-the-w2-form_50ef137271328.jpg)