Top Notch Tips About How To Start A Health Savings Account

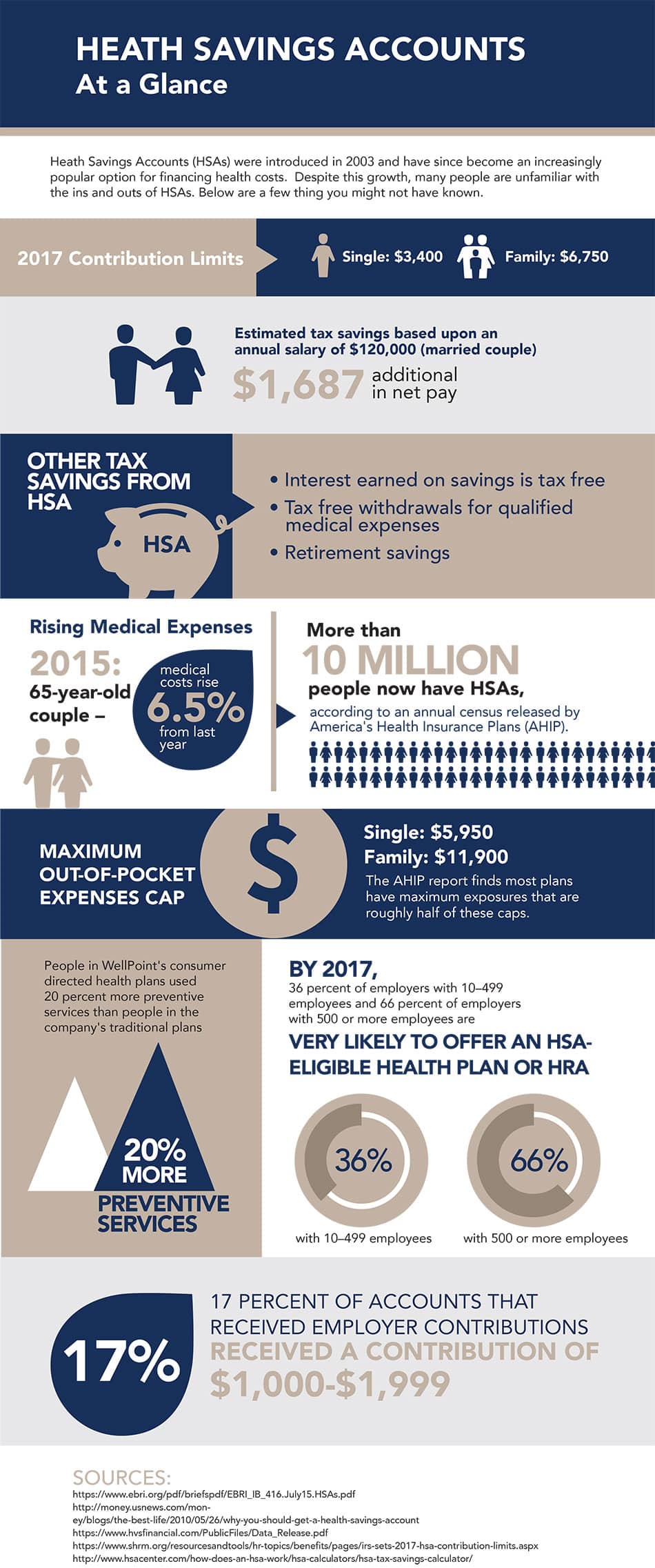

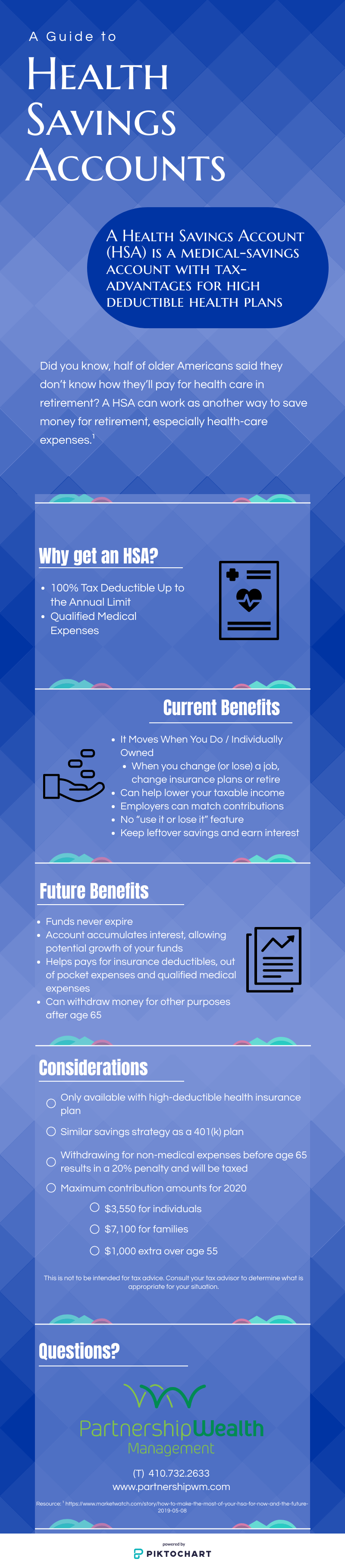

One way to manage your health care expenses is by enrolling in a high deductible health plan (hdhp) in combination with opening a health savings account (hsa).

How to start a health savings account. A health savings account can work just like a checking account. An hsa is a savings account that lets you set aside money to pay for qualified medical expenses. Health savings accounts or hsas can help you save for qualified medical spending.

A health savings account (hsa) is essentially a personal savings account that can be used only for medical expenses. You can make deposits (or contributions), pay bills online, make transfers, and even pay for. Who can open an hsa?

To be eligible, you must be enrolled in a. Who typically uses a health savings account? Cnbc select health savings accounts (hsa) can be used for both medical expenses and saving for retirement — here’s how you can get started health.

Disadvantages of a health savings. Learn where to find the best hsas and if an hsa is right for you. Advantages of a health savings account;

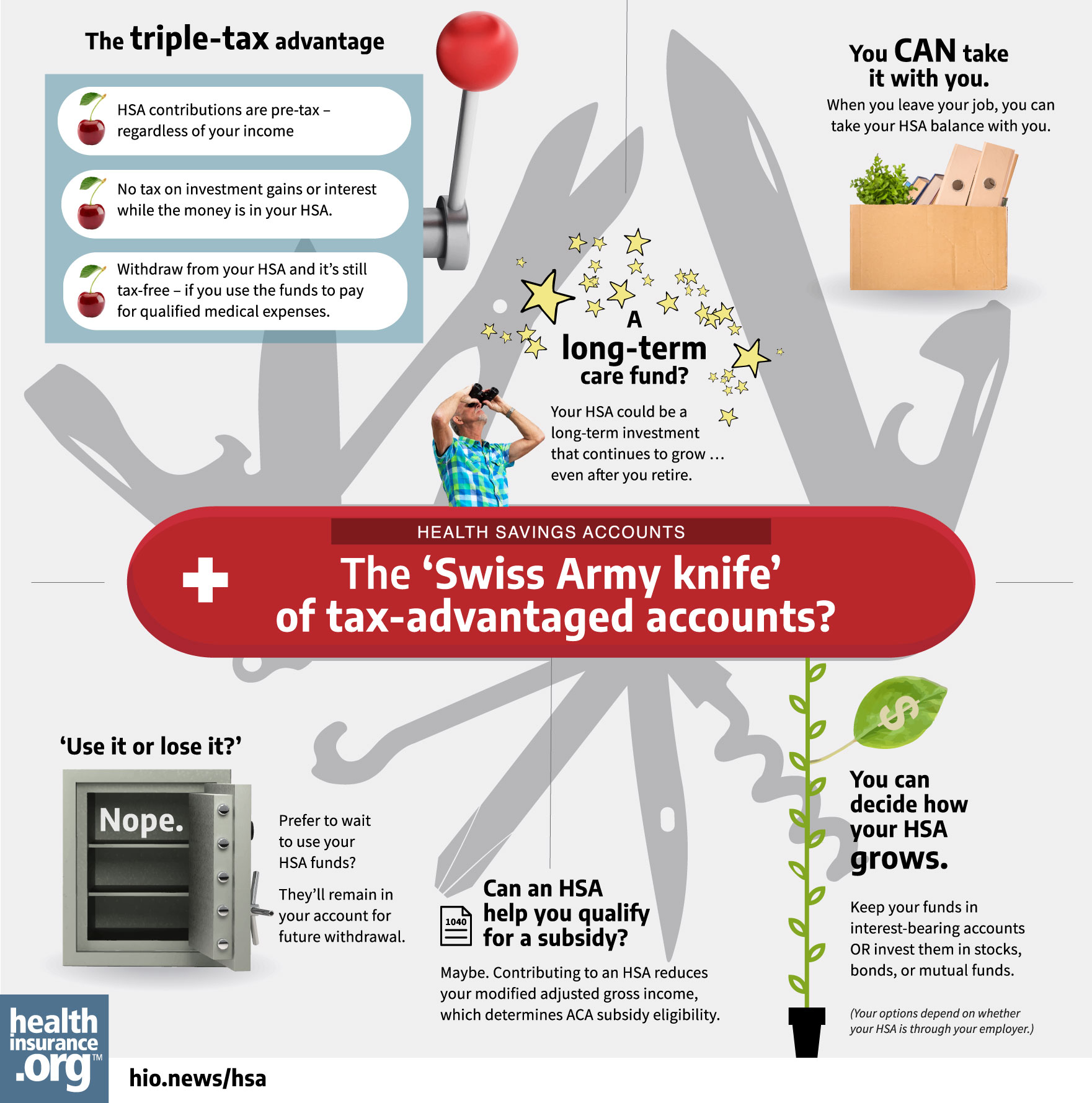

If you invested $200 in an hsa every month starting. Yes, you can open a health savings account (hsa) even if your employer doesn't offer one. It has a triple tax advantage.

Gobankingrates recently surveyed 1,063 americans aged 18 and older from across the country, asking how much they currently have in their savings account. How to get a health savings account. How health savings accounts work;

A health savings account (hsa) helps save toward medical expenses and also offers triple tax benefits. You can contribute up to $3,850 per year for. As long as you use the money.

The hsa is meant to offset the costs of. A 529 savings plan offers key tax incentives to start saving for your children’s education. You need to have an hdhp with a minimum deductible of $1,500 for an individual plan or $3,000 for a family plan.