Looking Good Tips About How To Start A Retirement Plan

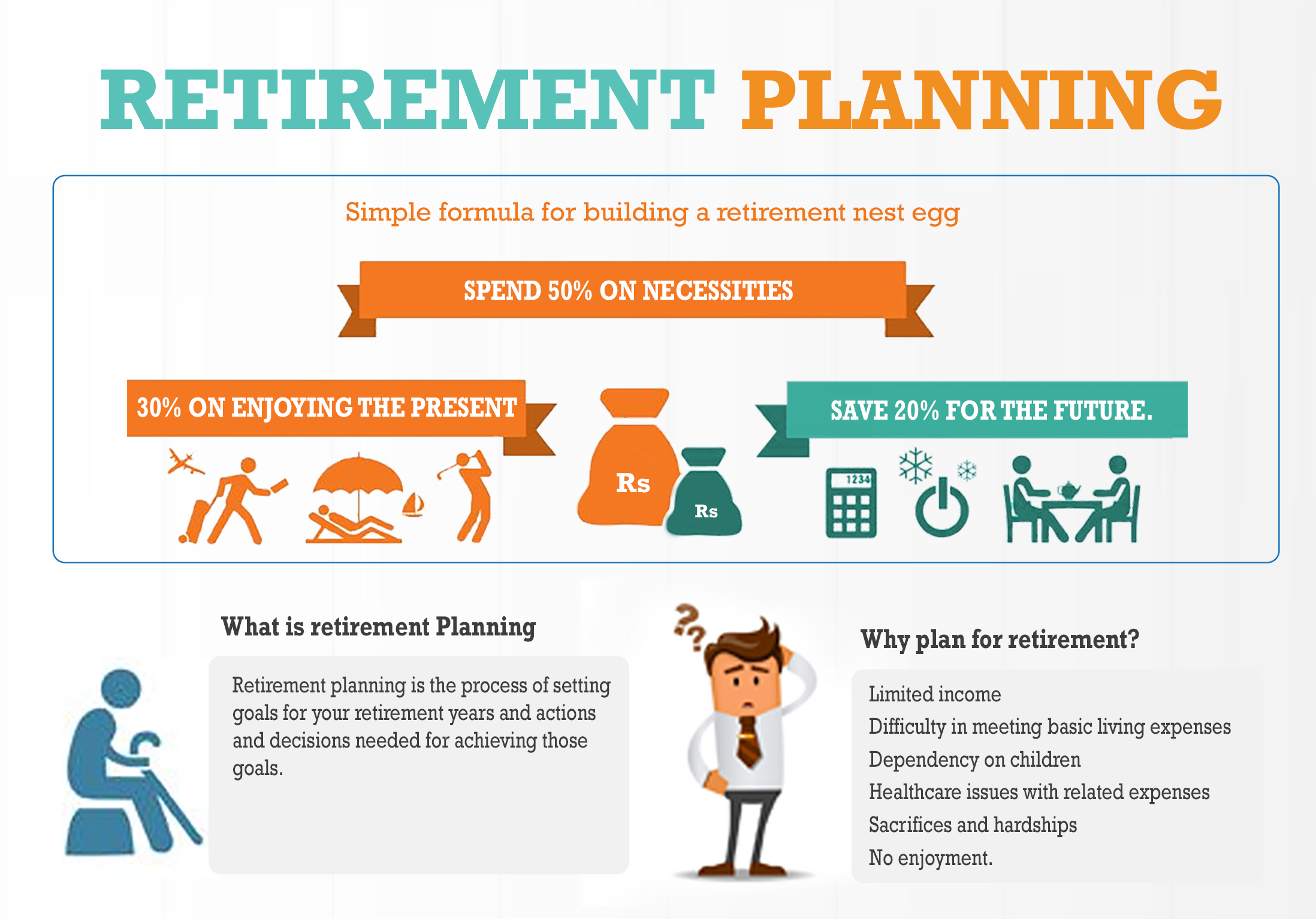

The 50/30/20 rule suggests allocating 50% of income to needs (such as housing, food, and utilities), 30% to wants (entertainment, dining out, hobbies),.

How to start a retirement plan. According to the fidelity retiree health care cost estimate, a single person age 65 in 2023 may need around $157,500 saved (after tax) to cover health care. Steps to starting your retirement plan. A report from the milken institute concluded that young adults need to begin regularly saving for.

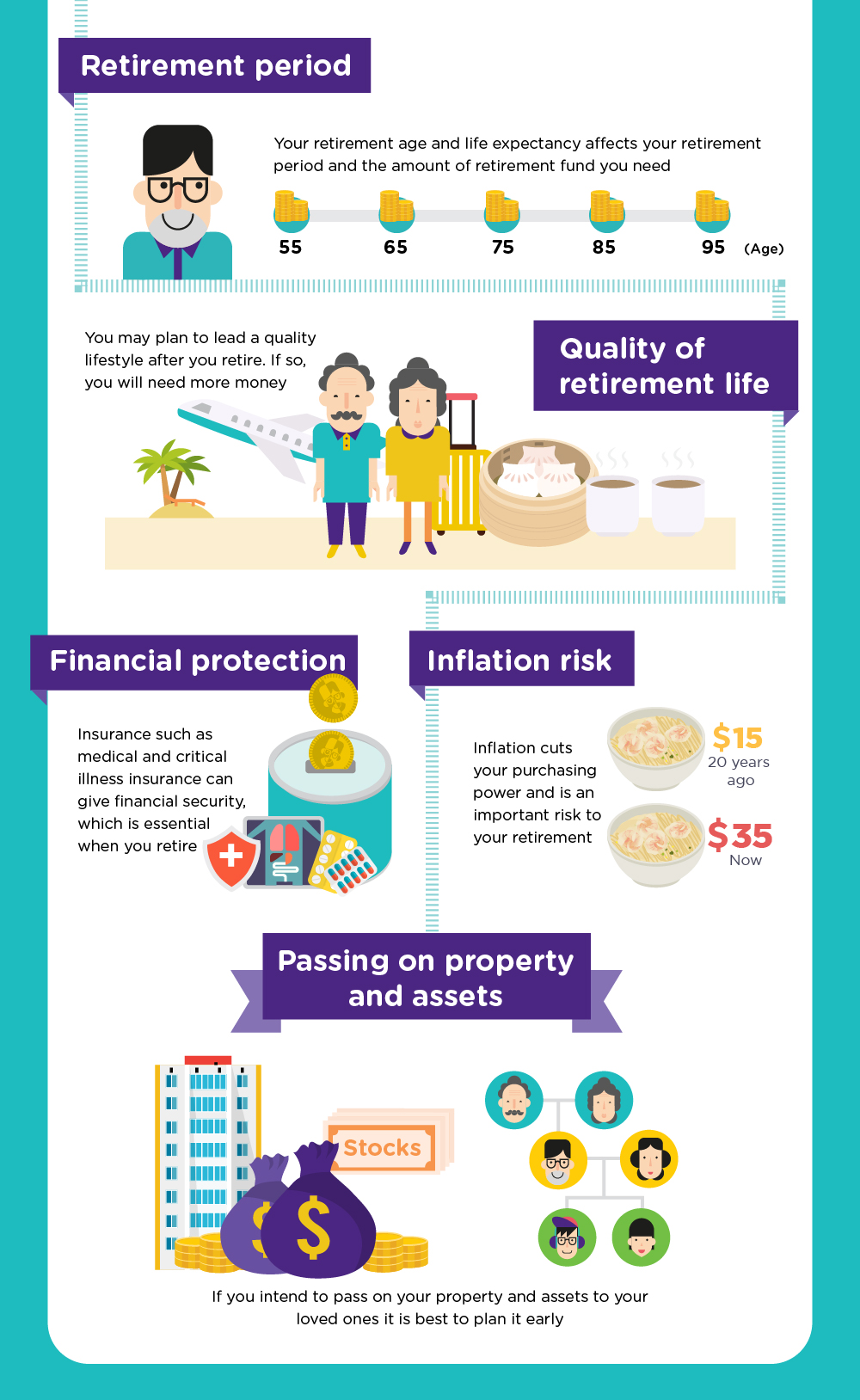

The sooner you start planning for retirement, the more money you can invest for the long term. Retirement financial advice can be all over the place, especially if you’re listening to a variety of experts. A retirement plan can help you ensure that you have enough retirement savings to live the life you want after you stop working.

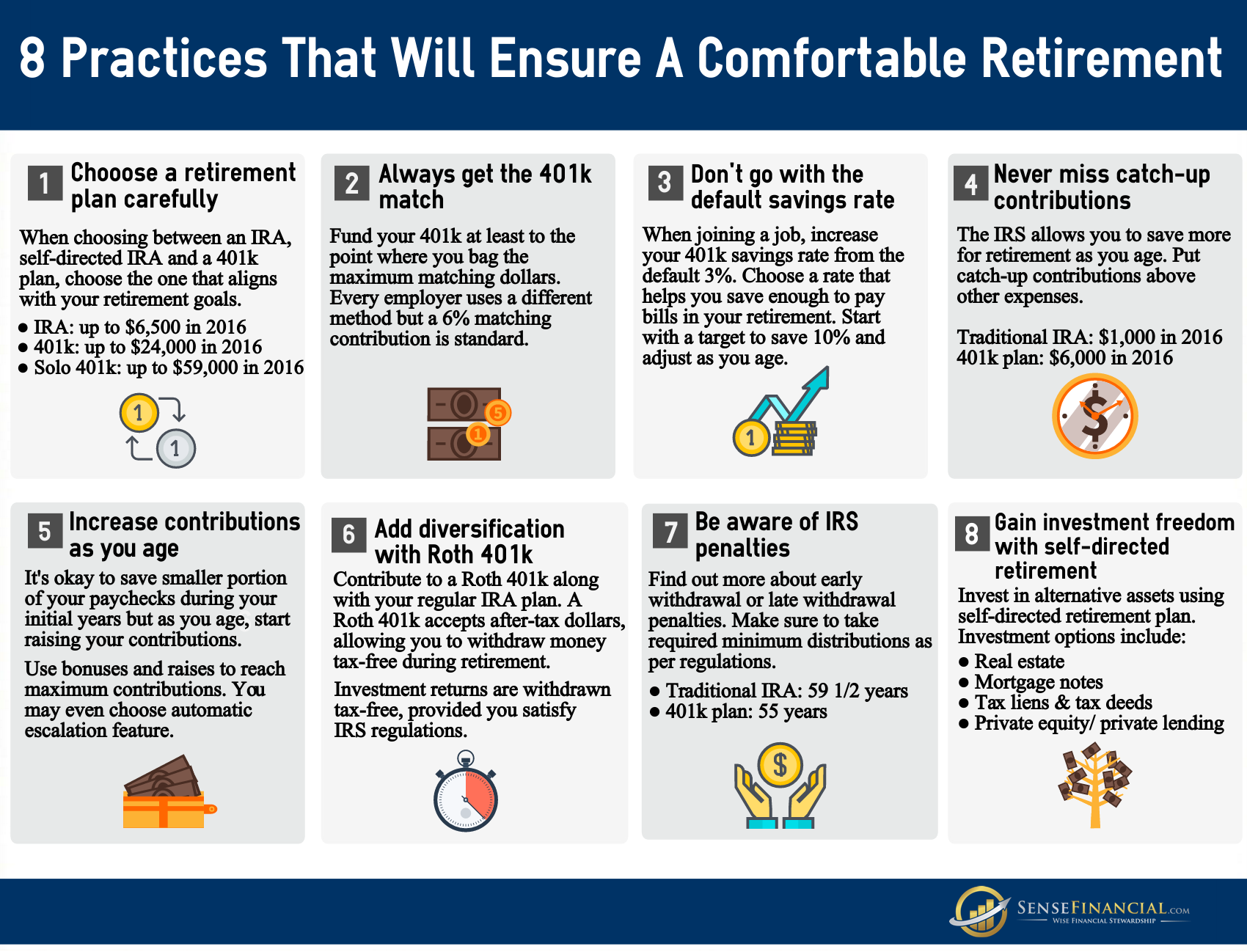

Save what you can and think about how you want to live with a decade to go, figure out how you’ll save as much as possible, says karen birr,. When it comes to retirement accounts, there are a few different options. Kotlikoff recommends waiting longer to retire and to begin collecting, often until age 70, which can deliver a much larger monthly payout than starting at 62 or 65.

Retirement planning refers to financial strategies of saving, investing, and ultimately. Here’s where you write your objectives down, listing the most. Get an idea how much your retirement income is likely to be.

Retirement accounts generally should be the most aggressive part of your overall investment portfolio because these accounts usually have the longest time. Define your retirement you probably have some idea of how you’d like to spend retirement. A goal may not mean an exact dollar figure.

Set up your savings to get you to your goal. In retirement, you may not earn a paycheck from working, but you will still receive income from your investments, as well as social security, pension payments,. Here’s how to get started planning for retirement at 40.

Retirement planning checklist. Decide when to start saving. Instead, think of this as a rough idea of how much.

By team stash better late than never: Consider all your current and potential expenses.. But so is the balance of your retirement.

Make a plan to pay off your debts. Key takeaways it is never too early or too late to start retirement planning. See how your retirement age affects your social security benefits.

Age may be just a number. 5 steps for retirement planning. Sign up 10 years: