Fun Tips About How To Keep A Balance Sheet

California resources merges with aera energy.

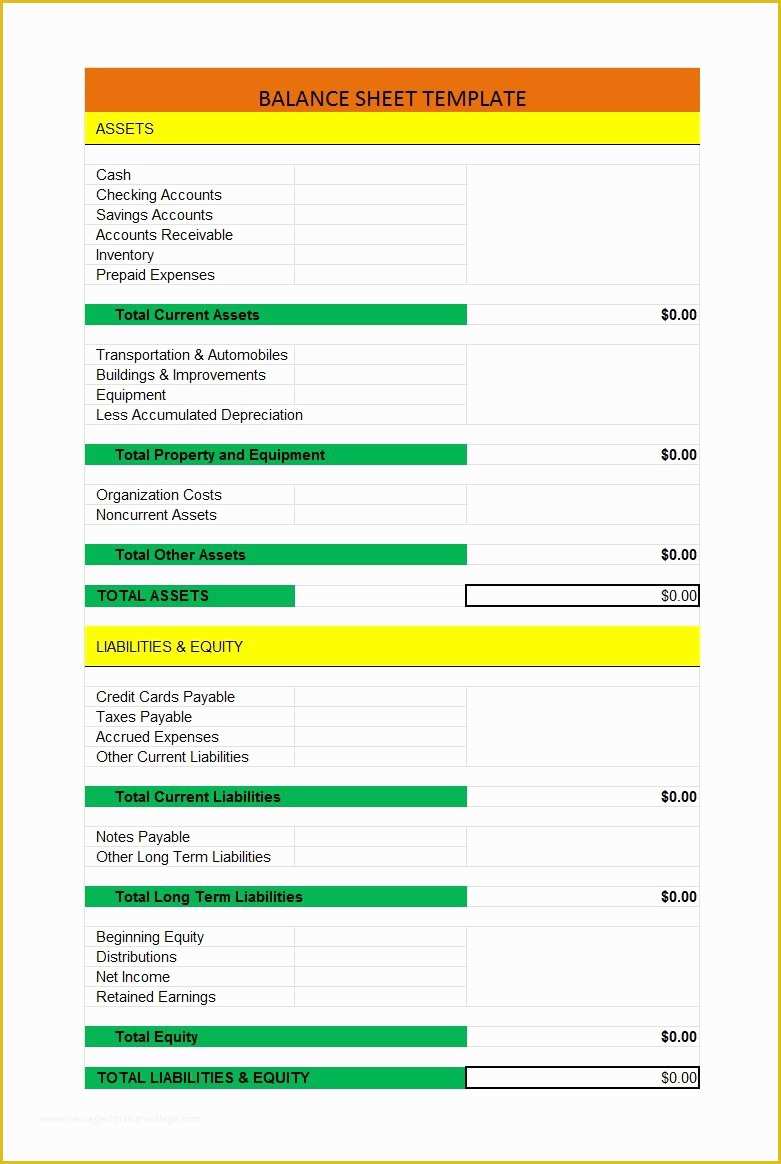

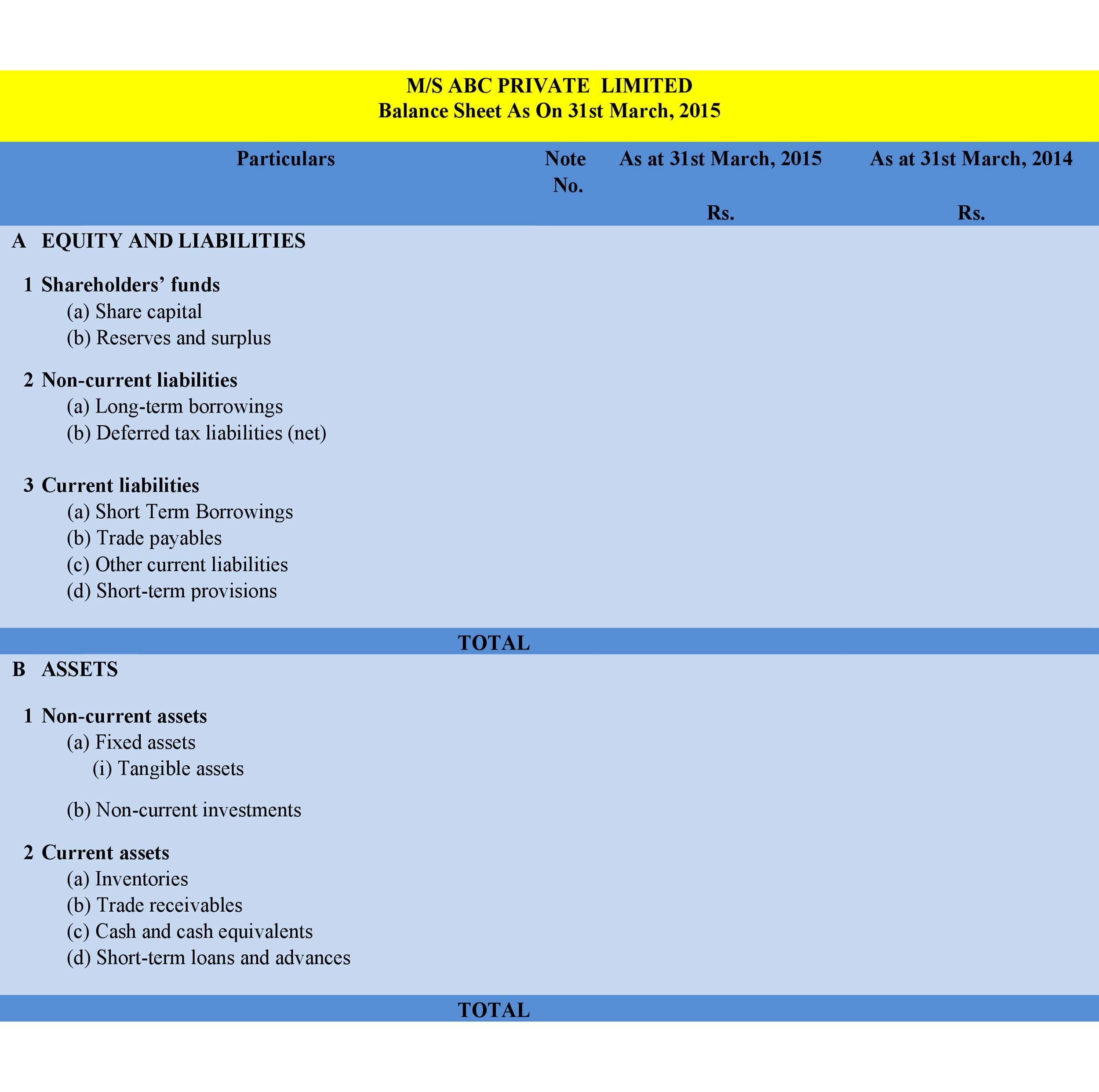

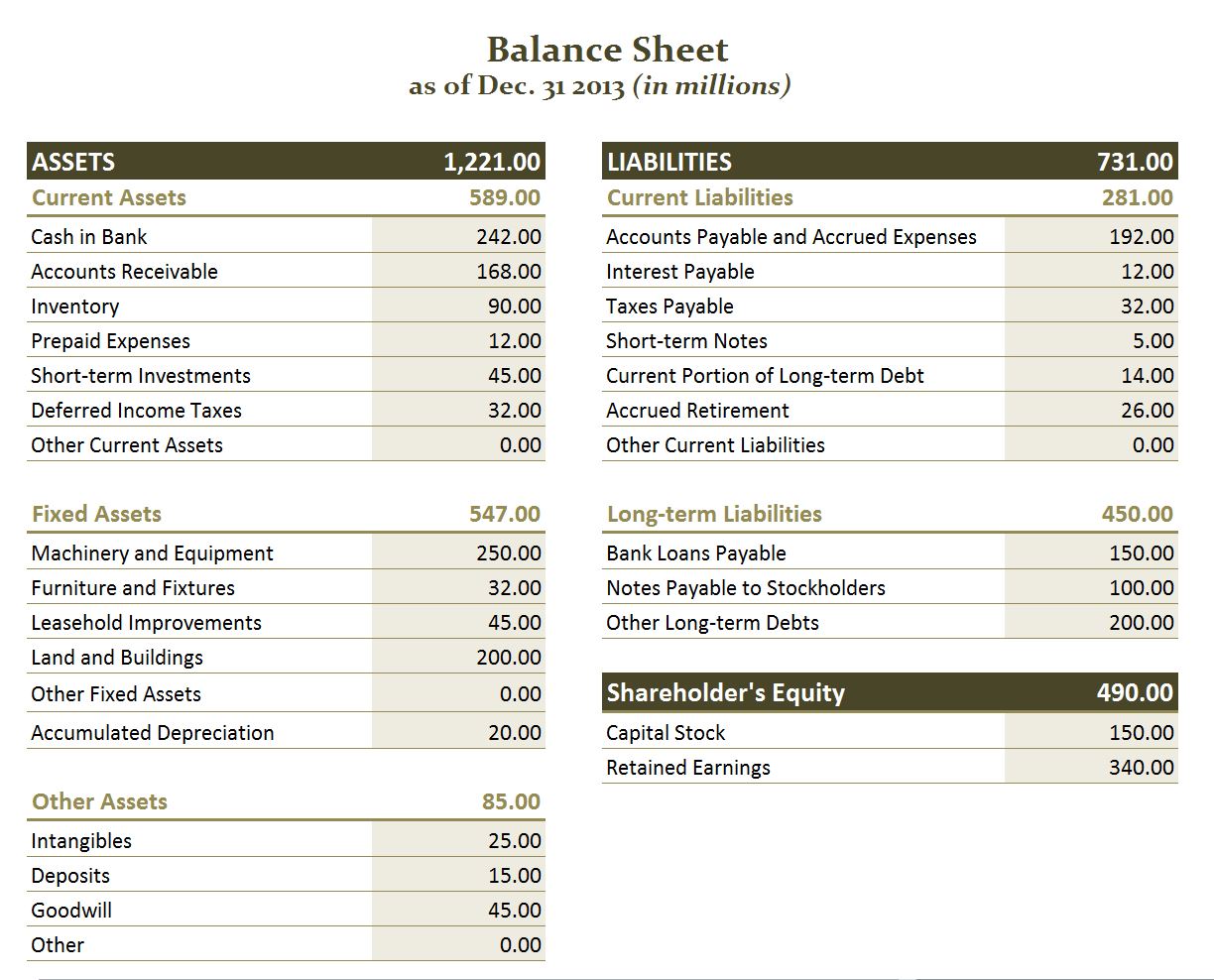

How to keep a balance sheet. The three financial statements are the balance sheet, the profit and loss statement, and the cash flow statement. The fundamental accounting equation states that a company’s assets must be equal to the sum of its liabilities and.

What is a balance sheet? The merger allows for the acquisition of. The btfp has allowed banks to get cash from the fed window without declaring a loss in their balance sheet.

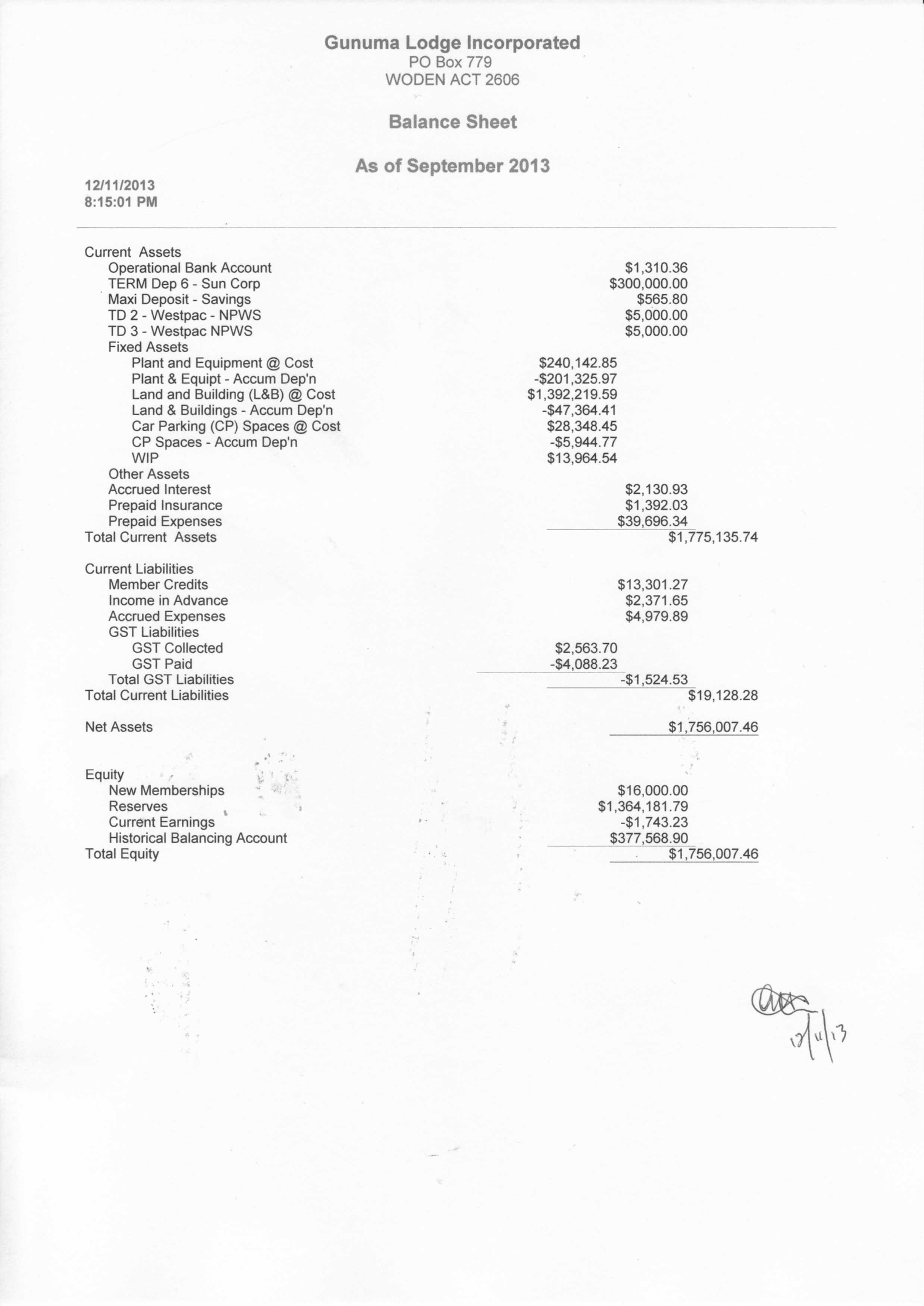

Learn what a balance sheet should include and how to create your own. It lists all of the. So on a balance sheet, accumulated depreciation is subtracted from the value of the fixed asset.

A balance sheet is a snapshot of the value of your business on a particular date. Your personal balance sheet really comes to life once you move on to calculating your net worth. The european central bank’s (ecb’s) audited financial statements for 2023 show a loss of €1,266 million (2022:

Making a balance sheet can be done in 5 simple steps. Follow these steps to create your own personal balance sheet. Business owners use these financial ratios to assess the profitability, solvency, liquidity, and turnover of a.

Zero) which will be carried forward on the ecb’s. It presents all assets and liabilities,. Balance sheets are needed for financial ratios.

A balance sheet, also known as a statement of net worth, is a summary of a company’s financial status at a specific point in time. D/e = total liabilities / total shareholders' equity = $152,969 /. However, banks still grapple with two issues in.

Your balance sheet shows your business assets (what you own), liabilities (what. Enter the amount of cash the business has available. For example, if you buy a car for $40,000 and expect it to last for.

Typically, a balance sheet will be prepared and distributed on a quarterly or monthly basis, depending on the frequency of reporting as determined by law or. Create a categorized list of your personal assets. Determine the reporting date and period.

Creating your personal balance sheet. A balance sheet includes a summary of a business’s assets, liabilities, and capital. Enter accounts receivable or the current amount.

:max_bytes(150000):strip_icc()/dotdash_Final_Balance_Sheet_Aug_2020-01-4cad5e9866c247f2b165c4d9d4f7afb7.jpg)